Don't Be Fooled. Our Economy is Still Stuck in Neutral

The gains on Wall Street have been goosed largely by government spending and guarantees, not the usual private sector–funded growth. And federal spending cannot continue indefinitely without deficits and debt service spiraling out of control. John Silvia, chief economist for Wells Fargo, says, “We have seen a recovery, but it’s driven primarily by federal spending and special federal projects. The character of this recovery is very different than we’re used to.”

Consider that 37 percent of the third-quarter GDP growth was due to motor vehicle purchases, which were stimulated almost entirely by the Cash for Clunkers program. “The third quarter was really just a lot of Cash for Clunkers spending that won’t be sustained in the foreseeable future,” Silvia says. (Final statistics for fourth quarter spending were not available at press time.)

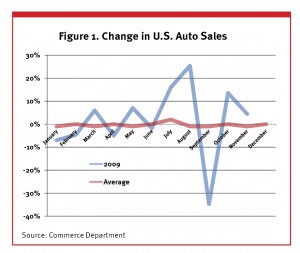

The car scheme, an attempt to jump-start the bankrupt auto industry, offered consumers a government-funded credit of up to $4,500 if they traded in their gas guzzlers for more eco-friendly vehicles. But since most participants probably were already planning to buy a new car, the program essentially shifted future demand for automobiles to the third quarter of 2009. Instead of continuing to grow, car sales dropped 34 percent immediately after the program ended. Figure 1 shows U.S. auto sales in 2009 largely following the 10-year average month-to-month change until the Cash for Clunkers credit jolted demand, followed by a subnormal drop.

This is not real growth. It’s the national equivalent of a credit-card buying spree, with the bills—in the form of debt service and unfunded liabilities—to be paid off later. It is a faux recovery.

This entry was tagged. Debt Fiscal Policy Spending